Audiologists’ Considerations with Malpractice Insurance

By Matt Gracey, President & CEO

Things to know when you are a provider in a multispecialty practice.

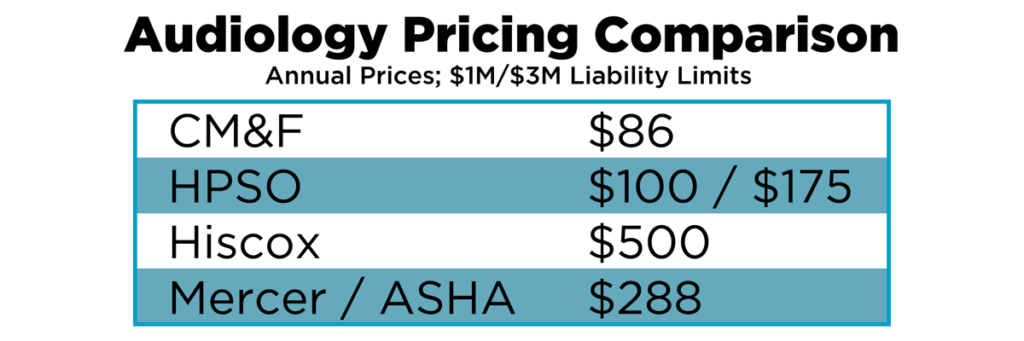

As we know the risks associated with audiology are pretty low compared with physicians’ and surgeons’ risks. Accordingly, the premiums for coverage are also very low and the coverage usually broad and comprehensive for the most part from the insurers that do offer this specialty coverage. However, there still are important considerations in purchasing coverage that every audiologist working with a medical practice needs to take into account.

The first and most important detail in the coverage arrangement for audiologists working with physicians, most commonly with otolaryngologists, is how the coverage is set up.

In many practices, we see audiologists included in the malpractice insurance covering the physicians and the practice’s corporate entity. Most standard physician’s malpractice insurance does not exclude audiologists so they are automatically included without any separate listings or paperwork. This coverage is always on a “shared limits” basis that automatically extends the same liability limits that the doctor and corporate entity carry. Sometimes the physicians are covered with their own set of limits and the corporation and employees are on a separate limit, but in both cases the audiologists are covered.

That is all easy and clean. However, we find that many audiologists then go out and purchase additional individual coverage from a different insurer, often with much higher liability limits than the practice and doctors purchase since the audiology coverage is so cheap. This independent coverage unfortunately creates two problems. The first is that if or when a claim arises involving the audiologist almost always the doctor and corporate entity are also sued, with the audiologist now involving their insurance company claims defense team of lawyers and company claims representatives while the physician and practice will be defended by a whole separate defense team. Predictably in most any arrangements like this with different defendants in the same lawsuit being defended by different insurers, finger-pointing and casting of blame to the other defendants becomes the plaintiff attorneys’ dream because of the divided defense. The vastly better defense strategy is to have a unified defense handled by one insurer.

The second problem with separate coverage from different insurers for the audiologists and doctors is that at least in Florida where most doctors carry relatively low liability limits, the audiologists are purchasing much higher limits than the doctors because the cost is so cheap. Higher limits can lead to being a “deep pocket” in a multi-defendant lawsuit, and that can become a big issue when different insurance companies are defending the doctors and audiologists.

Ultimately, it is recommended that audiologists and physicians practicing together purchase insurance, when possible, from the same insurance company.

For additional information, find details here.